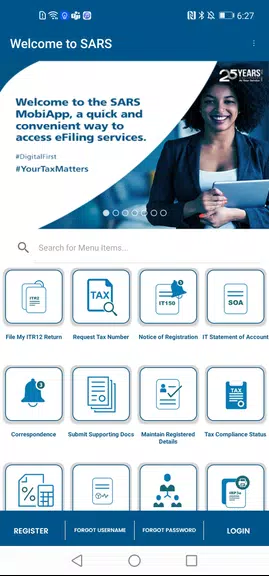

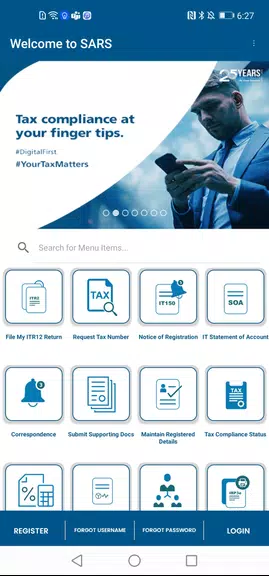

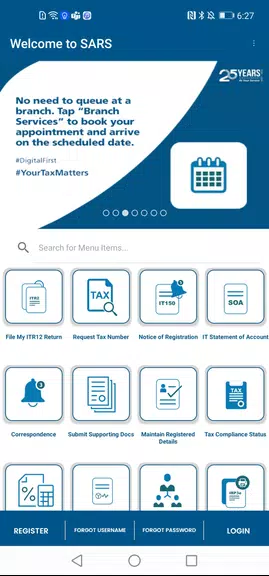

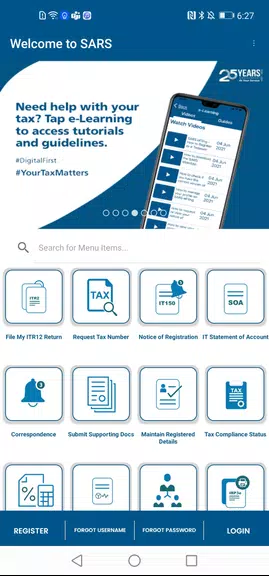

The SARS Mobile eFiling app revolutionizes tax filing in South Africa, offering a user-friendly mobile solution for completing and submitting Income Tax Returns. This innovative app empowers taxpayers to access their annual returns, conveniently save and edit them offline, utilize a built-in tax calculator for assessment estimations, and track their return status post-submission. It seamlessly blends simplicity and robust security, enabling anytime, anywhere tax management.

Features of SARS Mobile eFiling:

- Unmatched Convenience: File and submit your annual Income Tax Return directly from your smartphone, tablet, or iPad – making tax season a breeze.

- Effortless Accessibility: Manage your taxes anytime, anywhere, offering unparalleled flexibility and convenience.

- Unwavering Security: Rest assured knowing your information is securely encrypted, protecting your data throughout the filing process.

- Smart Tax Calculator: Estimate your tax assessment outcome with the integrated tax calculator, facilitating effective budgeting and financial planning.

Frequently Asked Questions:

- Is the SARS Mobile eFiling app secure? Yes, the app employs robust security measures, encrypting all submitted information to safeguard user data.

- Can I access past tax returns through the app? Yes, you can view summaries of your Notice of Assessment (ITA34) and Statement of Account (ITSA) within the app.

- Can I use the app for business tax filings? Currently, the app is designed for individual taxpayers filing personal Income Tax Returns only.

Conclusion:

The SARS Mobile eFiling app is an indispensable tool for South African taxpayers seeking a streamlined and efficient tax filing experience. Its convenient, accessible, and secure features simplify the process, regardless of your eFiling experience level. Download the app today and experience the future of tax filing – at your fingertips.