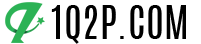

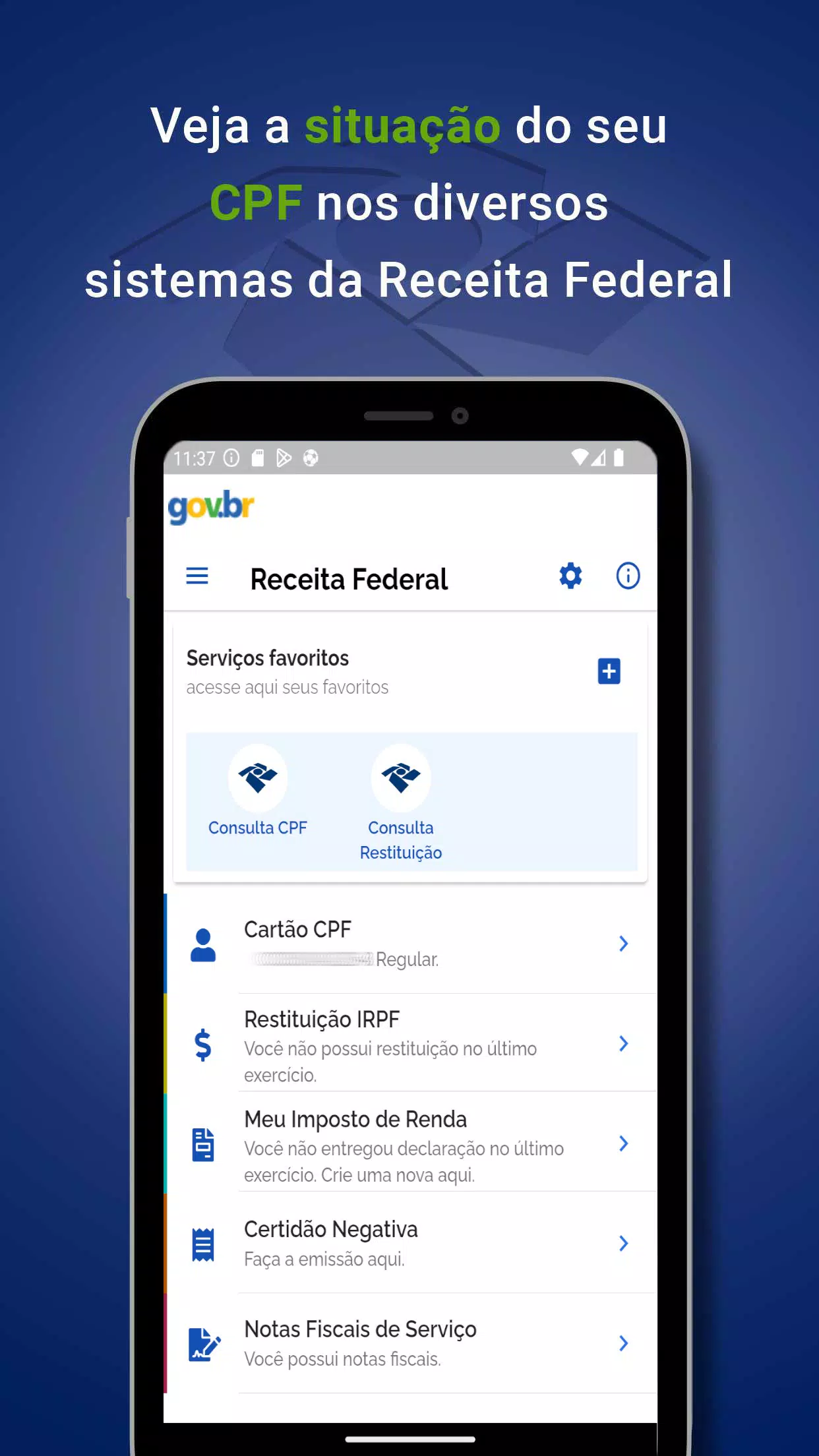

The Internal Revenue Services for citizens provide a comprehensive overview of the CPF (Cadastro de Pessoas Físicas) within various Federal Revenue systems. These services are designed to streamline access to essential tax and financial information, making it easier for individuals to manage their fiscal responsibilities. Some services require the download of additional Federal Revenue applications, marked with an asterisk (*).

The application offers a range of information and services, including:

- CPF card

- Negative certificate of debts

- IRPF refund

- Income tax declarations*

- Processes in progress*

- Economic activities – CAEPF

- Schedules - SAGA*

- eSocial – domestic employees*

- My companies (including MEI*)

- My imports (Import declarations and Bill of Lading)

- Refund requests via PERDCOMP

- Service Invoices

- Health Recipe

In addition to these services, users can also access information on CNPJ registration, MEI status, CNAE, NCM tables, RFB Units, legal regulations, Sicalc, import simulation, and many other services. This comprehensive suite of tools ensures that citizens have all the necessary resources at their fingertips to manage their tax obligations effectively.

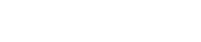

The way queries are handled depends on the user's authentication status:

- Unauthenticated Users (without gov.br): You will only have access to basic data. You won't be able to favorite any information, and you will need to complete a captcha for each query.

- Authenticated Users (with gov.br): You will not need to complete a captcha, and you can favorite the numbers you consult, making future queries more convenient. Soon, you will also receive alerts about any movements related to your queries.

- Consulting Third-Party Data: You will be able to view basic information about third parties.

- Consulting Your Own Data (My Data): You will have full access to all your personal information, ensuring you can manage your tax affairs with complete transparency and ease.

By providing these services, the Internal Revenue Services aim to enhance user experience and ensure that citizens can efficiently navigate their tax responsibilities, whether they are managing their own data or accessing information about third parties.